- by Yueqing

- 07 30, 2024

-

-

-

Loading

Loading

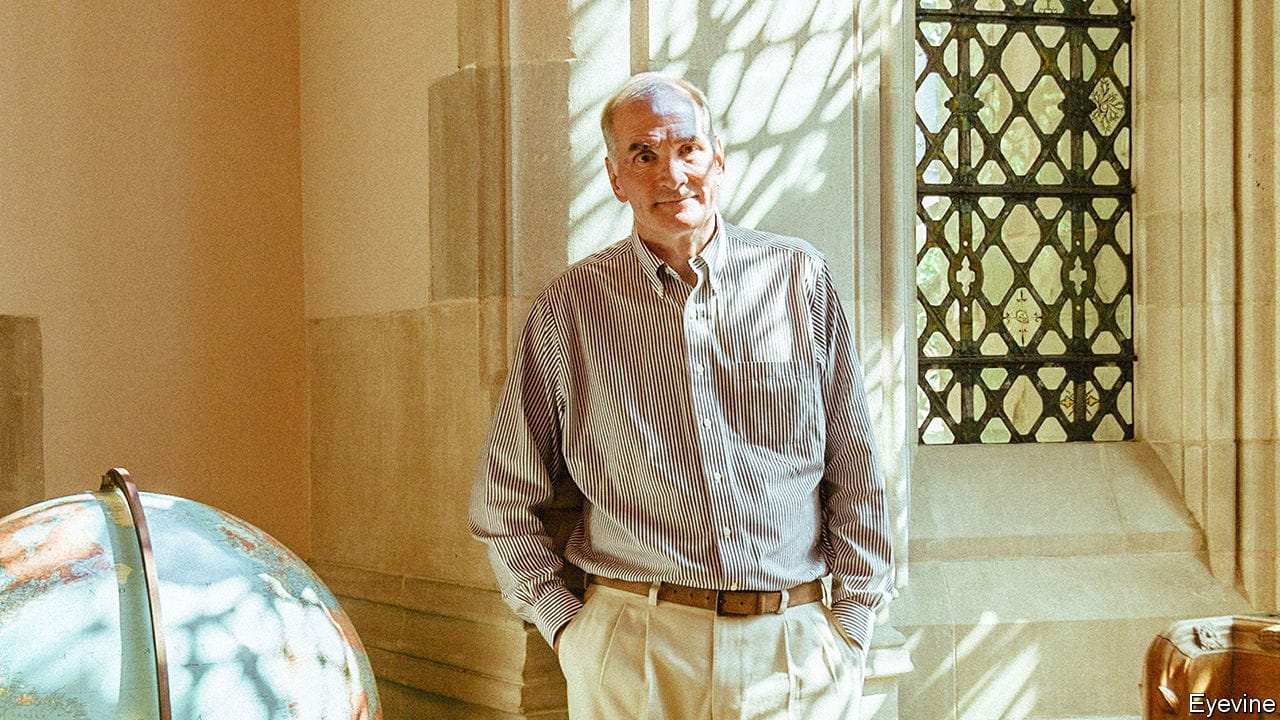

STARTING IN THE 1980s, the endowments of a handful of big American universities began to divert their investments away from publicly traded equities and bonds towards “alternative” assets, such as venture capital and private equity. David Swensen, who died on May 5th aged 67, perfected the approach. Referred to variously as the endowment, Yale or Swensen model, it has since been copied—by family offices, sovereign-wealth funds and, more recently, by big pension funds.In 1985 Mr Swensen was persuaded by James Tobin, a Nobel-prizewinning Yale economist, to give up a lucrative career on Wall Street to return to his former university to run its investment office. Yale’s endowment was then worth around $1bn. By the middle of last year the figure had risen to $31bn. Even this astonishing growth understates Mr Swensen’s influence. He was responsible for developing a stream of talented asset managers at Yale. And in two best-selling books, he set down his investment philosophy for a wider audience.